The Prolific 7, Inc. is dedicated to providing financial education to low and middle income families. We believe that financial literacy is a critical life skill that everyone should have access to, regardless of their income level. Our mission is to empower individuals and families with the knowledge and skills they need to make informed financial decisions, manage their money effectively, and achieve their financial goals.

We offer a wide range of programs and services to help individuals and families achieve financial stability. Our programs are designed to be easily accessible and affordable, with resources tailored to meet the needs of our clients. We have workshops, eBooks, one on one counseling, and online resources. If you have a question or need support, don’t hesitate to contact us.

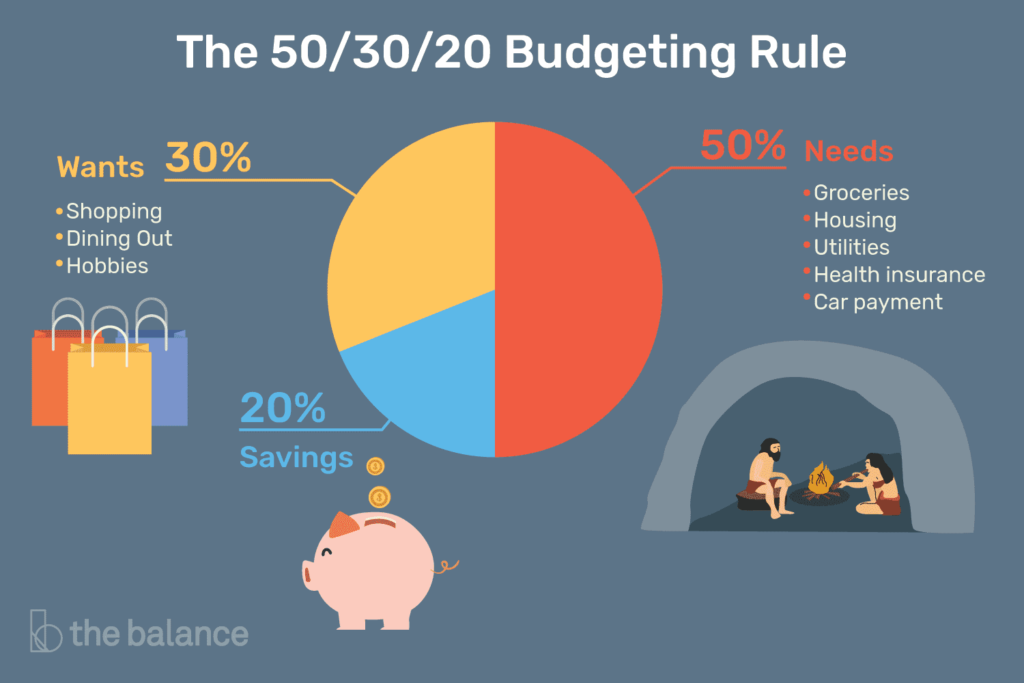

Our financial education workshops provide practical information and hands-on training on a variety of financial topics. From budgeting and saving to credit management and retirement planning, our workshops cover the essential skills that are necessary for financial success. Our experienced instructors are knowledgeable and passionate about helping individuals and families improve their financial literacy, and they provide practical guidance and support to help clients achieve their goals.

Our financial coaching services provide one-on-one guidance and support to help individuals and families achieve their financial goals. Our coaches work with clients to develop personalized financial plans, set realistic goals, and implement strategies to achieve those goals. Whether it's reducing debt, improving credit, saving for a down payment on a home, or planning for retirement, our coaches provide the guidance and support clients need to achieve financial success.

Our financial coaching services provide one-on-one guidance and support to help individuals and families achieve their financial goals. Our coaches work with clients to develop personalized financial plans, set realistic goals, and implement strategies to achieve those goals. Whether it's reducing debt, improving credit, saving for a down payment on a home, or planning for retirement, our coaches provide the guidance and support clients need to achieve financial success.

Our website provides a wealth of online resources and tools to help individuals and families improve their financial literacy. From interactive budgeting tools and financial calculators to informative articles and videos, our website is a valuable source of information and guidance for anyone seeking to improve their financial knowledge and skills. Our online resources are available 24/7, so clients can access the information they need whenever it's convenient for them.

We believe that financial education is a community effort, and we work closely with community organizations, schools, and other partners to provide financial education services to those who need them most. Our outreach efforts include partnerships with local schools to provide financial education to students, as well as collaborations with other non-profit organizations to provide financial coaching services to low-income families.

We believe that financial education is a community effort, and we work closely with community organizations, schools, and other partners to provide financial education services to those who need them most. Our outreach efforts include partnerships with local schools to provide financial education to students, as well as collaborations with other non-profit organizations to provide financial coaching services to low-income families.

We rely on the support of volunteers and donors to help us achieve our mission of improving financial literacy in low- and middle-income families. There are many ways to get involved, including volunteering at our workshops and events, donating to support our programs, and spreading the word about our services to those who may benefit from them. To learn more about how you can get involved and support our mission, please visit our website.

We believe that financial education is a critical life skill that everyone should have access to, regardless of their income level. Our programs and services are designed to be accessible and affordable, with resources and tools tailored to meet the needs of our clients. We are committed to empowering individuals and families with the knowledge and skills they need to make informed financial decisions, manage their money effectively, and achieve their financial goals. Thank you for considering our organization, and we look forward to working with you to improve financial literacy in our community.

©2024 The Prolific 7, Inc. All Rights Reserved.